You’re probably familiar with the concept of compounding returns — the idea that if you invest some money and it earns some money, those earnings will then earn money, and those earnings will then earn money, and on and on, eventually turning into a lot.

For example, let’s say a young person was wise beyond his years. He saved a good portion of all that he received as gifts or for his allowance or that he earned, ending up with $2,000 by the time he turned 16. At that point, he decided to invest it. Let’s say he knew someone who worked at Sound Mind Investing (ahem) who told him about an aggressive strategy called Sector Rotation.

Because the strategy is so aggressive, SMI normally recommends that people use it to manage no more than 20% of their portfolio. But our young person figures he’s young and can afford to take on a lot of risk, so he invests his entire $2,000 using the strategy.

Even though Sector Rotation generated an average annual return of 13% for the 20 years through 2019, he’s going to be a tad more conservative in his estimates and count on an average annual return of just 12%

Give it time

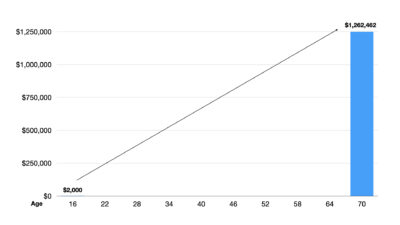

If he never adds another dime to his account, and if it generates an average annual return of 12%, by the time he’s 70, his $2,000 will have turned into more than $1.2 million!

But here’s an important point you have to understand about compounding returns. Those gains will not be earned along a straight line like what you see below.

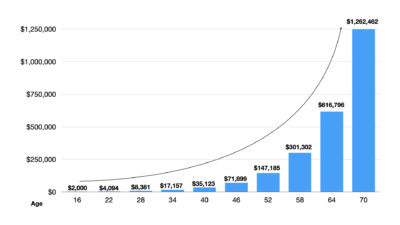

Instead, the account’s growth will look more like this.

When our now 16-year-old graduates from college, his $2,000 will have grown to $4,000. That may not seem all that exciting. At age 28, when he may be thinking about marriage, his account will show a balance of just over $8,000. Not a big deal. Even at 46, when he may be feeling middle-aged, he’ll have just $72,000.

But the next few points on the chart do start to look interesting. The balance jumps to about $150,000, then to over $300,000, and then to over $600,000. And that last jump? Wow. It goes from about $600,000 to $1.2 million!

Wait for it

Here’s another really important point about how compounding works: $2,000 turning into $4,000 is the same percentage increase as $600,000 turning into $1.2 million. Both figures doubled in value over the same six-year period of time. But what would you rather have: $2,000 turning into $4,000 or $600,000 turning into $1.2 million?

The thing is, in order to enjoy that last big bump, you have to put in the time. You have to be patient as $2,000 turns into $4,000, and as $4,000 turns into $8,000.

This is the rule of 72 in action. Take a rate of return, divide it into 72, and that’ll tell you how long it will take for your money to double. In our example, our 12% rate of return divided into 72 is 6. That’s why the chart shows the returns in six-year increments.

Take one more step

Here’s one final important point about compounding. You will first qualify to receive Social Security benefits at age 62, and that’s when the majority of people choose to begin taking their benefits. But each year that you wait, up to age 70, your monthly benefit amount will grow quite a bit.

And when you factor in what could happen with your retirement portfolio by waiting, you could have a lot more to live on in your later years. By giving that money one more doubling period — in our example, six more years — retiring at age 70 instead of age 64 would make a $600,000 difference.

Please take these lessons of compounding to heart, and teach them to your kids.

Take it to heart: “Steady plodding brings prosperity; hasty speculation brings poverty.” – Proverbs 21:5

Take action: Are you investing enough for your later years each month? And are you investing that money by using a trustworthy investment strategy? If you can’t answer both of those questions with a confident, “yes,” I strongly recommend investing 15 minutes of your time to watch this free webinar.

Read more: Success Goes To The Steady, Not The Speedy

Comments are closed.