We’re all drawn to stories of people who achieve “overnight success.” They make for great headlines and sell a lot of magazines and books. Problem is, they’re a myth.

In the business classic, “Good to Great,” author Jim Collins explored the reasons why some companies break away from their pack of competitors and achieve remarkable, sustained success. While there was usually a point in time when they did, in fact, break away, it was not at all about some new idea that suddenly rocketed them to the top. It was the result of steadily doing the right things over a long period of time.

Steady plodding brings prosperity; hasty speculation brings poverty. – Proverbs 21:5

Collins calls it, “turning the flywheel,” and there’s an important lesson here for all who want to achieve uncommon financial success.

Steady Progress in the Right Direction

A flywheel is a heavy disk that helps to maintain a constant speed of rotation in a machine or to store energy. Collins describes it as “a massive metal disk mounted horizontally on an axle, about 30 feet in diameter, 2 feet thick, and weighing about 5,000 pounds.”

Imagine trying to get it to turn.

It takes every bit of muscle you can muster. You push and push. After several hours you get it to make one full rotation. You keep pushing. Eventually it moves a little faster — a little faster. Hours later you’re getting that crazy contraption to make two rotations per hour.

People laugh at you. They tell you to stop. They say whatever you’re striving for isn’t working.

But the flywheel represents the steps you’re taking in pursuit of your dream or a goal that matters to you. So you keep going, and finally it becomes easier. In fact, at some point you notice that the wheel is moving from its own momentum.

Collins found that in all of the companies he studied — the ones that achieved unusual success — this was their pattern. They found one thing that mattered to them, focused all of their energy on that one organizing idea (their “hedgehog concept”), and they just… kept… going.

In the early years, no one noticed. There were no media articles, no shareholder parties. Just a lot of steady plodding, until one day they realized it wasn’t taking so much effort. Sales went up, and kept going up. The distance between them and their competitors became greater and greater.

The media started calling. Headlines were written about the company’s “overnight success.” But there was nothing overnight about it. They had been pushing the flywheel — for a long time.

This is a perfect illustration of how things work with money.

The Financial Flywheel

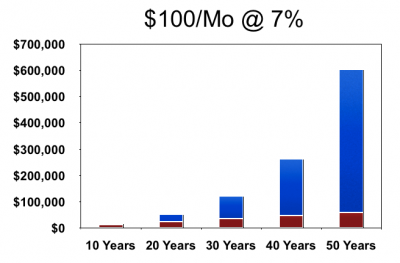

Look at the chart below. It shows the result of someone — let’s call her Jean — steadily putting $100 into an investment that generated an average annual return of 7 percent. The red represents Jean’s money. The blue represents the money she earned.

During the first 10 years, it’s pretty much all red. After 20 years, it’s about even. It would be easy for doubt to creep in. Or fatigue.

But then there’s a breakthrough. After 30 years, earnings are now greater than principal. But look at 40 years, and 50. The earnings tower over the principal.

This is the financial flywheel in action. Lots of steady plodding. Compounding doing its thing. Eventually, momentum.

Beware the Doom Loop

Over the years, Jean stayed the course. She followed an unbiased investing process she understood and trusted. Along the way, cousins talked over Thanksgiving dinner about a stock that was destined to take off. Conversations were heard around the water cooler about a “can’t miss” real estate deal.

Collins has a term for such ideas: “The Doom Loop.” It’s the company that bets it all on a big win. Or the leaders who doubted their direction, so they changed course, and then changed again.

Jean listened politely to her cousins and those around the water cooler. And she kept investing her $100 each month — stayed with her strategy, her process — one turn of the flywheel at a time.

She did it during good times, and she did it during bad times.

Seems like I heard this lesson somewhere else. Something about the race not being to the swift.

There are many applications beyond investing. Getting out of debt. Saving for the down payment on a house. Living within your means. Having monthly conversations about money with your spouse.

Steady plodding. Little steps in the right direction for a long time. It isn’t glamorous, but it’s what it takes to achieve uncommon success.

Where do you see the flywheel in action in your finances?

Comments are closed.